Call (08) 9721 4422

today for financial assistance.

KEEP UP TO DATE

Slide title

Keep Up to Date

Button

STAY UPDATED ON THE LATEST NEWS, TIPS & FINANCIAL INFORMATION

By proadAccountId-386310

•

12 Jun, 2018

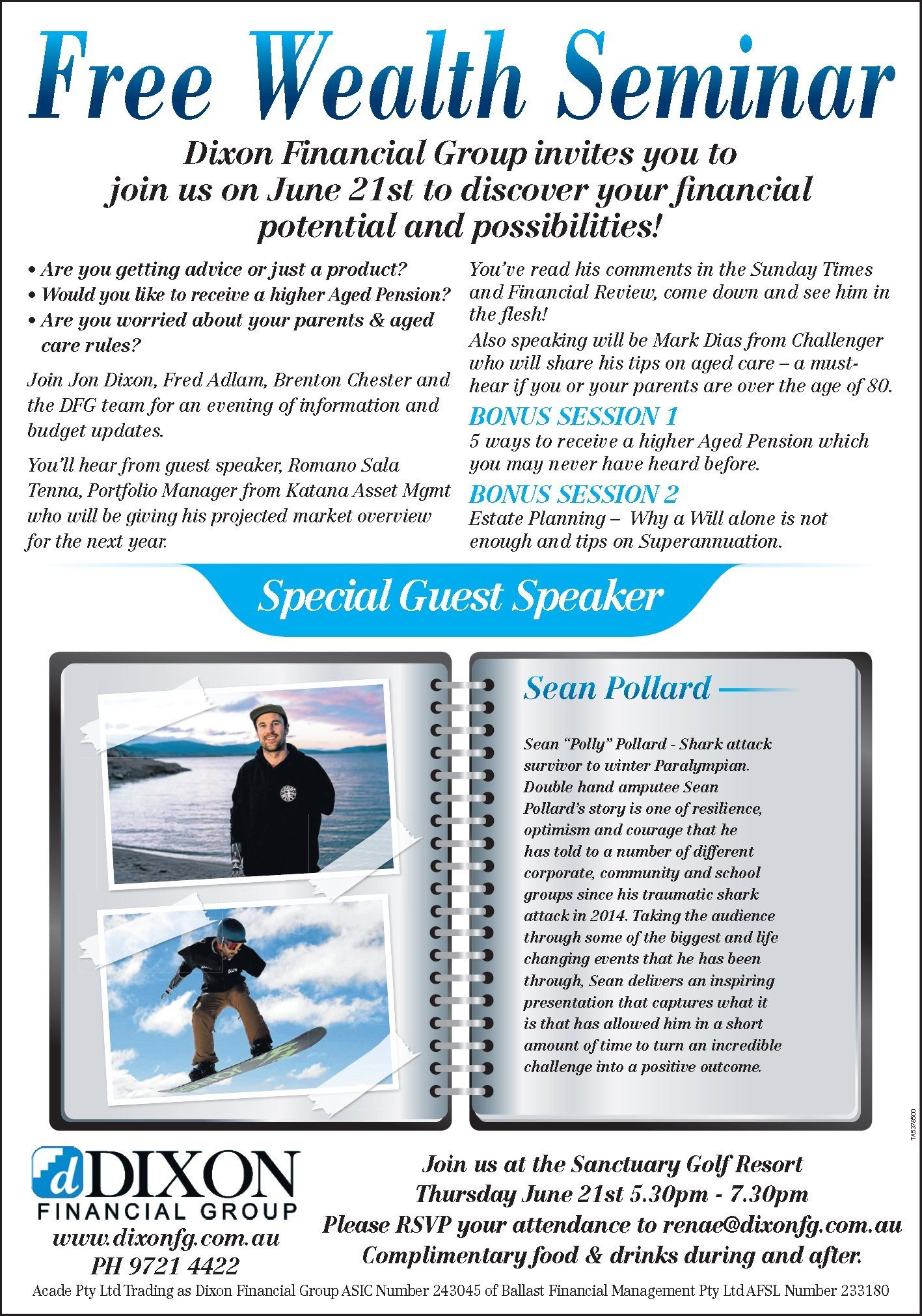

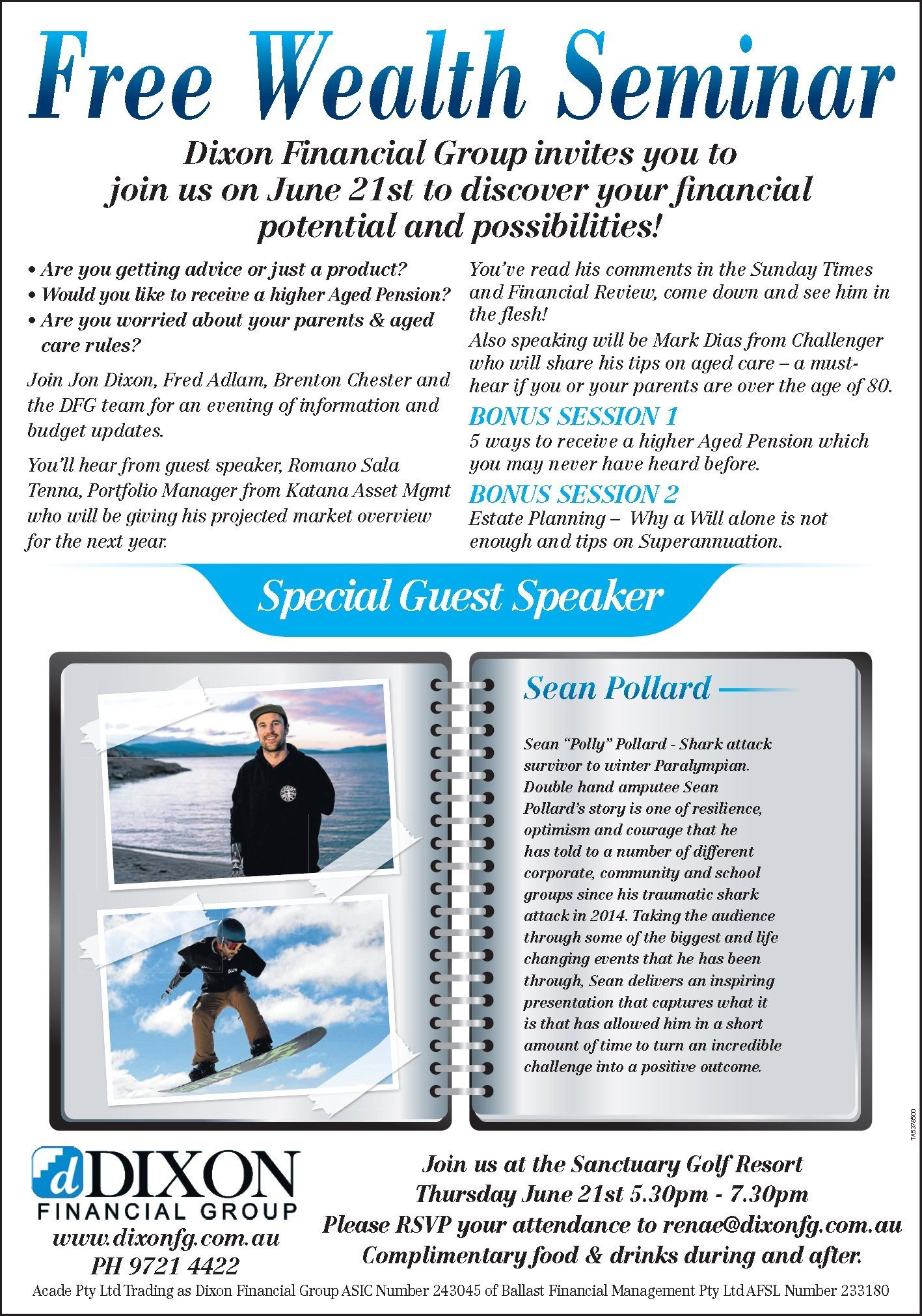

You’ll hear from guest speaker Romano Sala Tenna, Portfolio Manager from Katana Asset Management, who will be giving his projected market overview for the next year. Also speaking will be Mark Dias from Challenger who will share his tips on Aged Care – a must hear if you or your parents are over the age of 80.

Special Guest: Sean "Polly" Pollard - Shark attack survivor to winter Paralympian. Taking the audience through some of the biggest and life changing events that he has been through, Sean delivers an inspiring presentation.

Please RSVP your attendance to renae@dixonfg.com.au or by calling 9721 4422.

Special Guest: Sean "Polly" Pollard - Shark attack survivor to winter Paralympian. Taking the audience through some of the biggest and life changing events that he has been through, Sean delivers an inspiring presentation.

Please RSVP your attendance to renae@dixonfg.com.au or by calling 9721 4422.

By proadAccountId-386310

•

09 Jun, 2018

Funds promoted as ethical or socially responsible investment in Australia have more than quadrupled in size over the past three years to $622 billion under management, with returns keeping pace with mainstream investment vehicles.

Click here to read the full article by Chris Pash that was published by Business Insider Australia.

Click here to read the full article by Chris Pash that was published by Business Insider Australia.

By proadAccountId-386310

•

18 May, 2018

In this article, Bryan Ashenden

explains what generally happens to your super in the event of a divorce or the breakdown of a de facto relationship. Special attention is given to the additional considerations that have to be made by members of a Self-Managed Super Fund.

Click here to read the full article that was published on the Switzer Daily website.

Click here to read the full article that was published on the Switzer Daily website.

By proadAccountId-386310

•

14 May, 2018

Key extracts:

- Over the medium term, net Commonwealth debt is projected to be $108 billion (3.8 per cent of GDP) in 2028-29. Net Commonwealth debt has been climbing since the global financial crisis. The government claims to have "turned the corner" on debt and deficit, but the improvement will depend on some optimistic forecasts.

- Almost $125 million for about 2000 additional student places across three regional universities.

- $500 million over seven years for the Great Barrier Reef to improve water quality and address other environmental concerns.

- $5.3 million a year from 2018-19 for a new heritage grants program, bringing together existing heritage funding to help protect heritage places.

- 14,000 additional home care packages for older people with high-level needs - part of a $5 billion increase in aged care spending over four years.

By proadAccountId-386310

•

20 Feb, 2018

Market sell-offs are dramatic, writes MFS Investment Management's James Swanson

– but they can also create opportunities for savvy investors.

Click here to view the full article which was published on InvestorDaily's website.

Click here to view the full article which was published on InvestorDaily's website.

By proadAccountId-386310

•

15 Jan, 2018

SMSF investors with a high concentration of bank and high dividend stocks have been urged to diversify their exposure, with some of these stocks expected to face headwinds this year, according to an online trading platform.

Click here to view the full article by Miranda Brownlee , which was published by SMSF Adviser.

Click here to view the full article by Miranda Brownlee , which was published by SMSF Adviser.

By proadAccountId-386310

•

10 Jan, 2018

"As a result of these changes, travel expenditure incurred by individual investors inspecting and maintaining residential investment properties is no longer deductible," Ms Wang said. The solicitor noted that the verdict on SMSF property travel deduction was the result of individual SMSFs' abuse of the system. Quoting the Treasury Laws Amendment Bill 2017, Ms Wang said: "The position taken was that by disallowing travel expenditure incurred by individual investors, it would combat the 'widespread abuse around excessive travel expense claims relating to residential investment properties' in order to 'improve the integrity of the tax by addressing the systematic risk of excessive and incorrect claims for travel expenses associated with residential investment properties'."

Click here to view the full article by Lucy Dean , which was published on Nestegg's website.

Click here to view the full article by Lucy Dean , which was published on Nestegg's website.

By proadAccountId-386310

•

03 Jan, 2018

David Wright, Managing Partner and joint founder of Zenith Investment Partners, is of the opinion that passively managed portfolioscould behitespecially hard in the event of a market downturn.

Click here to read Tim Stewarts' article, "Zenith warns against investor ‘apathy’", that was published by InvestorDaily.

Click here to read Tim Stewarts' article, "Zenith warns against investor ‘apathy’", that was published by InvestorDaily.

By proadAccountId-386310

•

07 Nov, 2017

Click here

to read Scott Phillips' article, " Time to buy mining shares and dump insurance stocks? Not so fast

", that was published in the Sydney Morning Herald.

By proadAccountId-386310

•

23 Oct, 2017

Most Australians procrastinate preparing for retirement, according to the Retirement Readiness Report.

Click here to view the full article by Oksana Patron, published on Money Management's website.

Click here to view the full article by Oksana Patron, published on Money Management's website.

By proadAccountId-386310

•

12 Jun, 2018

You’ll hear from guest speaker Romano Sala Tenna, Portfolio Manager from Katana Asset Management, who will be giving his projected market overview for the next year. Also speaking will be Mark Dias from Challenger who will share his tips on Aged Care – a must hear if you or your parents are over the age of 80.

Special Guest: Sean "Polly" Pollard - Shark attack survivor to winter Paralympian. Taking the audience through some of the biggest and life changing events that he has been through, Sean delivers an inspiring presentation.

Please RSVP your attendance to renae@dixonfg.com.au or by calling 9721 4422.

Special Guest: Sean "Polly" Pollard - Shark attack survivor to winter Paralympian. Taking the audience through some of the biggest and life changing events that he has been through, Sean delivers an inspiring presentation.

Please RSVP your attendance to renae@dixonfg.com.au or by calling 9721 4422.

By proadAccountId-386310

•

09 Jun, 2018

Funds promoted as ethical or socially responsible investment in Australia have more than quadrupled in size over the past three years to $622 billion under management, with returns keeping pace with mainstream investment vehicles.

Click here to read the full article by Chris Pash that was published by Business Insider Australia.

Click here to read the full article by Chris Pash that was published by Business Insider Australia.

By proadAccountId-386310

•

18 May, 2018

In this article, Bryan Ashenden

explains what generally happens to your super in the event of a divorce or the breakdown of a de facto relationship. Special attention is given to the additional considerations that have to be made by members of a Self-Managed Super Fund.

Click here to read the full article that was published on the Switzer Daily website.

Click here to read the full article that was published on the Switzer Daily website.

By proadAccountId-386310

•

14 May, 2018

Key extracts:

- Over the medium term, net Commonwealth debt is projected to be $108 billion (3.8 per cent of GDP) in 2028-29. Net Commonwealth debt has been climbing since the global financial crisis. The government claims to have "turned the corner" on debt and deficit, but the improvement will depend on some optimistic forecasts.

- Almost $125 million for about 2000 additional student places across three regional universities.

- $500 million over seven years for the Great Barrier Reef to improve water quality and address other environmental concerns.

- $5.3 million a year from 2018-19 for a new heritage grants program, bringing together existing heritage funding to help protect heritage places.

- 14,000 additional home care packages for older people with high-level needs - part of a $5 billion increase in aged care spending over four years.

By proadAccountId-386310

•

20 Feb, 2018

Market sell-offs are dramatic, writes MFS Investment Management's James Swanson

– but they can also create opportunities for savvy investors.

Click here to view the full article which was published on InvestorDaily's website.

Click here to view the full article which was published on InvestorDaily's website.

Follow Us

1 / 153 Victoria Street, Bunbury, WA 6230 (08) 9721 4422

© Copyright 2020 | All Rights Reserved | Dixon Financial Group

| Web Design by ACM Digital