Self Managed Super Fund… Is It Time To Make The Move? by Dixon Financial Group

- By lemaster

- •

- 09 Dec, 2016

The days when most people invested their Superannuation in Industry or Retail Super Funds – allowing Fund Managers to make investment decisions on their behalf – are slowly becoming a thing of the past.

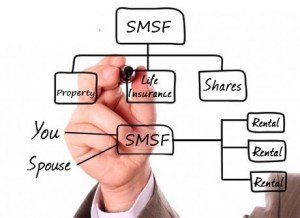

With a Self Managed Super Fund, you can be in total control of the way your Super benefit is invested. If you’re disappointed with your Super Fund’s performance, if you would like to have a bigger say about the way in which your hard-earned Super dollars are invested or if you’d like to transfer other assets into your Super fund (such as property, shares or term deposits), a Self Managed Super Fund may be just the solution you’re after.

Whatever the reason, now may be the time to consider changing the way your Super Fund is managed. If you’d like to find out about your options, give DIXON FINANCIAL GROUP a call on 9721 4422 today.

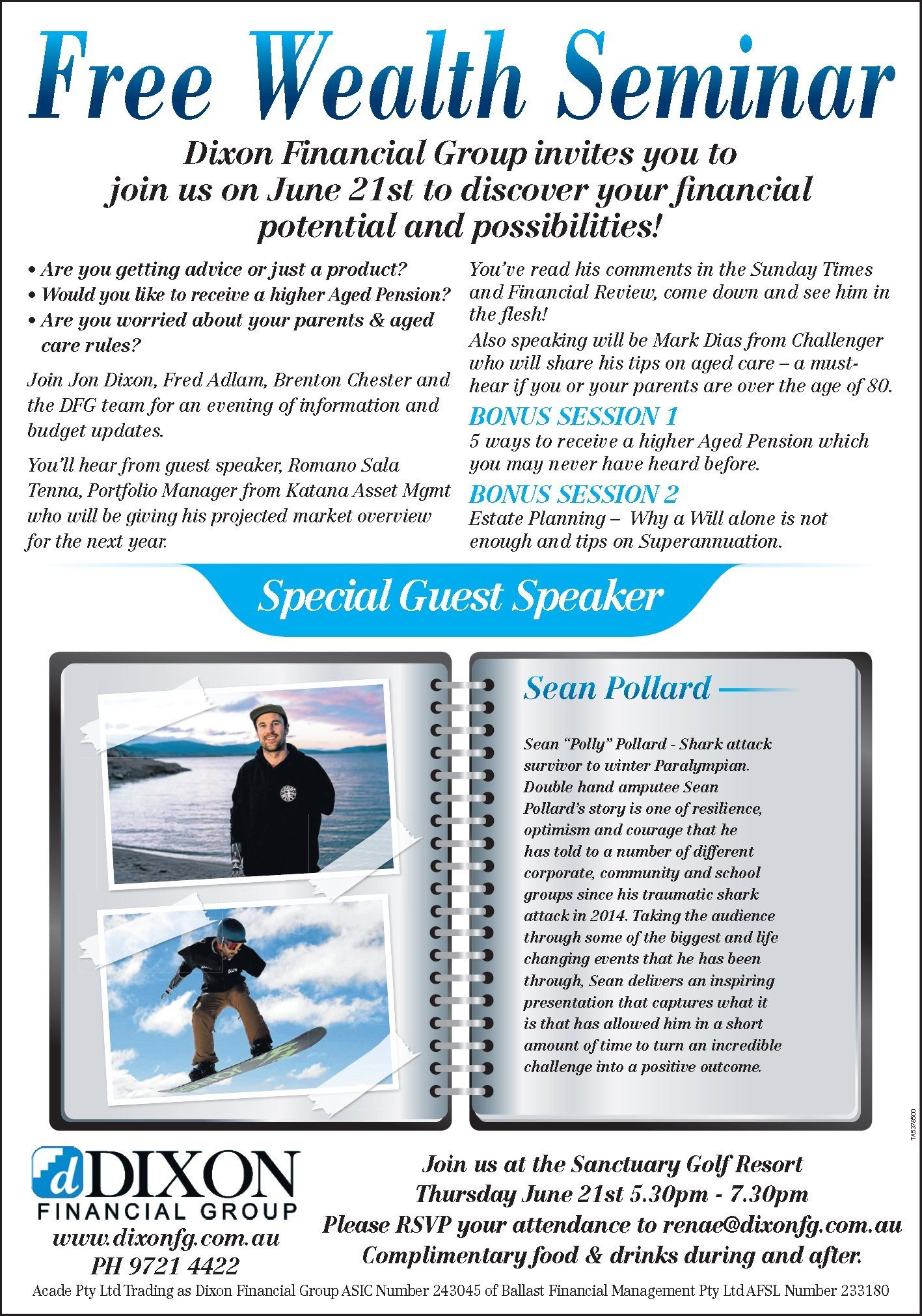

Special Guest: Sean "Polly" Pollard - Shark attack survivor to winter Paralympian. Taking the audience through some of the biggest and life changing events that he has been through, Sean delivers an inspiring presentation.

Please RSVP your attendance to renae@dixonfg.com.au or by calling 9721 4422.

Click here to read the full article by Chris Pash that was published by Business Insider Australia.

Click here to read the full article that was published on the Switzer Daily website.

- Over the medium term, net Commonwealth debt is projected to be $108 billion (3.8 per cent of GDP) in 2028-29. Net Commonwealth debt has been climbing since the global financial crisis. The government claims to have "turned the corner" on debt and deficit, but the improvement will depend on some optimistic forecasts.

- Almost $125 million for about 2000 additional student places across three regional universities.

- $500 million over seven years for the Great Barrier Reef to improve water quality and address other environmental concerns.

- $5.3 million a year from 2018-19 for a new heritage grants program, bringing together existing heritage funding to help protect heritage places.

- 14,000 additional home care packages for older people with high-level needs - part of a $5 billion increase in aged care spending over four years.

Click here to view the full article which was published on InvestorDaily's website.

Click here to view the full article by Miranda Brownlee , which was published by SMSF Adviser.

Click here to view the full article by Lucy Dean , which was published on Nestegg's website.

Click here to read Tim Stewarts' article, "Zenith warns against investor ‘apathy’", that was published by InvestorDaily.

Click here to view the full article by Oksana Patron, published on Money Management's website.